Online Church Accounting Software

Online Church Accounting Software

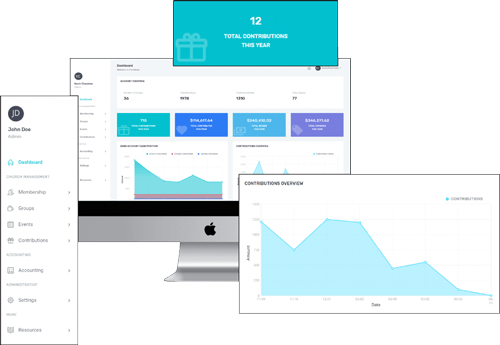

provides churches with a simple and easy solution to track their checkbook, income, expenses, payroll, and designated funds. Easy-to-use screens allow the user to input checks, deposits, paychecks, credit card charges, budgets, and to print comprehensive financial reports. These reports include Budget versus Actual Comparison reports for income and expenses and a Balance Sheet Roll-forward report for designated funds and the general fund.

Church Accounting Software can grow with your church. Track an unlimited number of transactions, funds, accounts, employees, and payees at no additional charge.

- All of your bank account balances

- Fund balances for your General Fund and all of your designated funds

- Compare actual income and expenses to your budget

- Track payroll for employees and print their year-end W-2s

- Prepare numerous Balance Sheet, P&L, and General Ledger reports

- More than 25 financial reports in all

- Print checks and paychecks on readily available check stock

- Print 1099s for contractors at year-end

- Personal support and continuing updates to the software

- 100% Satisfaction Guarantee

Is FlockBase Online Church Accounting Software easy to use?

Yes, our software is straightforward to use. FlockBase Online Church Accounting Software is a register-based system. If you can enter checks and deposits into a register, you can use our software. When it is time to join a check, just input the date, check number, payee, amount of the check, and which expense account it belongs to (e.g., Utility expense). That’s it. Entering a check cannot be simpler than that. Deposits are entered the same way. Please join the date, the amount of the deposit, and the income account it belongs to (e.g., General Fund Contributions, Building Fund Contributions, etc…). Do you need to split a deposit among more than one fund?

No problem, FlockBase Accounting allows you to split a check or deposit among as many incomes or expense accounts as you need. No problem, do you want to reconcile your checkbook to your bank statement (which is always an excellent idea)? FlockBase Accounting has a screen that allows you to quickly reconcile the checkbook to the bank statement by clicking off the checks and deposits that cleared the bank statement.

Is converting from a prior accounting system to FlockBase accounting easy?

It can be. Getting started on the right foot with FlockBase Accounting is going to hinge upon two factors:

- Setting up the funds and accounts properly,

- Have a balanced set of books before you start.

Setting up the funds and accounts is as easy as we described above. And, we have a User Guide that provides detailed step-by-step instructions for setting up your funds and accounts.

Having a good set of books before converting to any new accounting system is a must. In other words, there is not any new accounting software in the world that can straighten out a mess that humans created over the years. The adage, “garbage in, garbage out,” is still true today and applies to most aspects of life. This certainly applies to your accounting system. Although our accounting software is straightforward to use, if you input incorrect figures initially, those inaccurate figures will stay there until you correct them.

If you feel that you have a mess on your hands and you think you need help unraveling the mess, we can offer you support there too. A practicing CPA developed our software. His CPA firm can provide you with professional accounting consulting services (for a fee, of course) to help you decipher the mess you have and get started on the right foot. Or, you could use a local CPA to help you straighten out your existing records. If a CPA will just take a few moments to browse our User Guide, the CPA will quickly understand how our software works and should be able to help you transfer your beginning balances into our software.

Please contact us if you have any questions about how the software works.