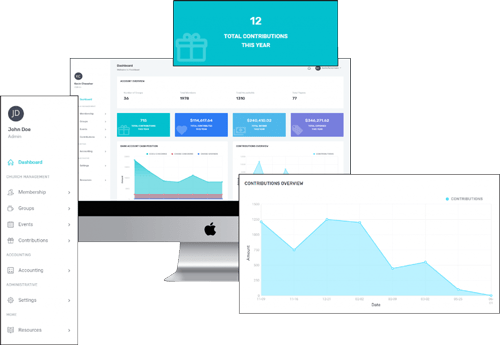

Church Software

This book explains the process to follow when selecting church software. It includes guidance on:

- How to assemble a software selection team

- Perform a needs assessment

- Review and evaluate the package

- Select and implement the system

One of the issues that make the search for the software so difficult, is the inherent complexity of fund accounting. I have included a discussion of the mechanics of fund accounting in the book as well.

Church Software:

This question and answer book address the following church accounting topics:

- Classification of ministers, employees, and contractors

- Minister’s housing allowance

- Minister’s self-employment tax

- Employee expense reimbursements

- Church employee benefits

- Structuring minister’s compensation package

- Withholding and paying church payroll taxes

- Preparation of Forms 941, W-2, and W-3

- Preparation of Forms 1099 and 1096

- Tax-exempt status for churches

- Church contribution records and year-end statements

- Preparation of monthly church treasurer’s reports

Small Church Accounting

can be an intimidating task. However, armed with the proper information, church accounting can be a source of stability and blessing within your church.

It is clear from Jesus’ teaching that he intends for Christians to obey national laws. Therefore, it is important for churches to comply with the United States Internal Revenue Code while providing the maximum tax benefits to their ministers and employees. Church accounting is not easy. It is different from business accounting in several key areas.

This site also contains free information regarding church accounting software and fund accounting.

Contact us for support or questions