Church Accounting Features

We've designed FlockBase to make tracking church finances simple for volunteers & staff alike.

Track Funds

FlockBase is built with true fund accounting, allowing you to easily track your fund balances.

Compute Payroll

We make it simple for churches to pay their staff & comply with IRS regulations.

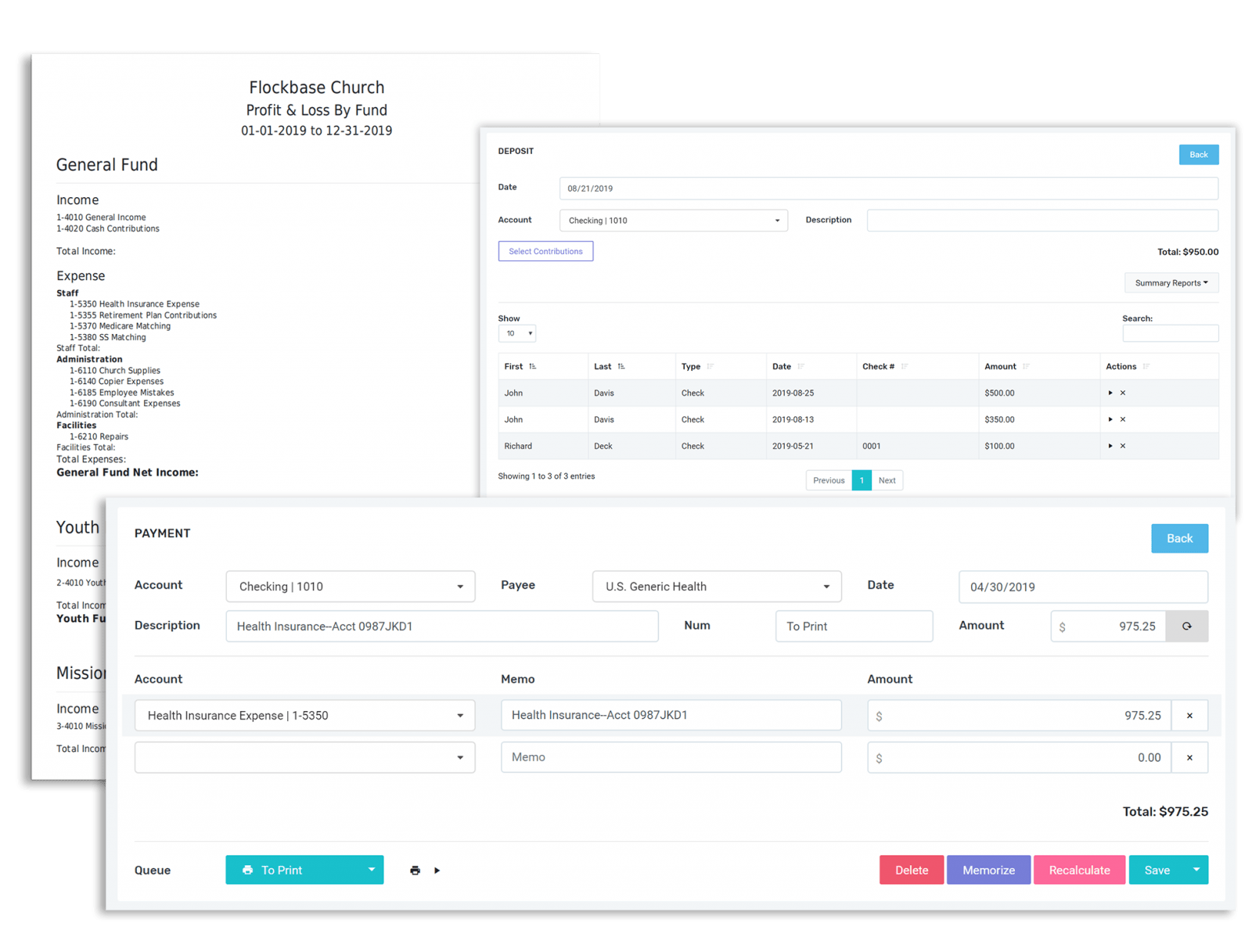

Robust Reporting

Track balances, income and expenses by fund, from a high level down to the ledger, and more!

Check Printing

Our software makes it easy to create & print checks to pay your vendors and staff.

Budgets

Make budgeting a breeze! Track your church's spending and compare it to your budget.

Direct Deposit

Our recommended cloud packages enable you to pay your staff and vendors directly.

Versatile yet Simple

Built to help churches of all sizes, we pride ourselves in remaining versatile yet simple.

With minimal training and setup, your church's staff and volunteers can easily learn & use the software.

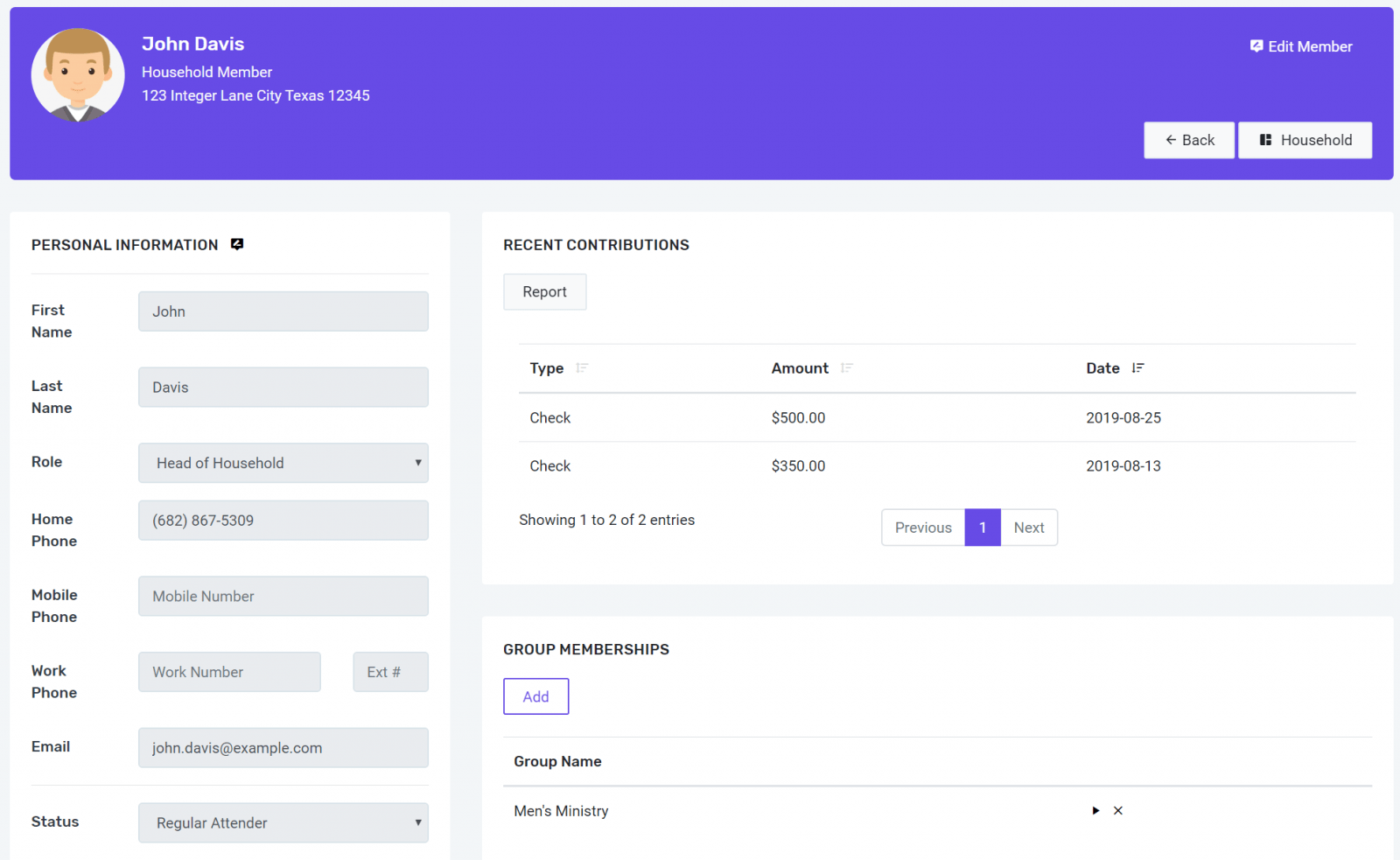

Fully-Integrated with our Membership & Contribution Software, and Online Giving!

FlockBase is built as an affordable, all-in-one church management experience. This means that your contributions can easily be associated with your membership and flow seamlessly into your accounting.

Client Testimonials

Don't just listen to us! Ask any of the thousands of customers we've worked with since 2006!

"Easy to do the job I need to do. Saves time because it always works as it is designed. Very easy to use church software."

Sally E.

Church Volunteer

"I love Flockbase! A few years ago my pastor gave me permission to get a new church management program. We had been using a well-known expensive program that I really wasn't happy using. So, I searched the internet and that was how I found this program."

Julia P.

Church Clerk

Check Out Our Prices!

Save time & money for your church! We offer rates we’re pretty proud of.

Basic

$24

per month

For modest ministries

- Membership & Groups

- Accounting

- Top Notch Support

- Contributions & Pledges

- —

- 2 Users

- Unlimited Names

PLUS

$39

per month

For small and midsize churches

- Online Giving

- Payroll

- Direct Deposit

- Integrated Emailing

- Everything from Basic

- 5 Users

- Unlimited Names

PRO

$59

per month

For larger or savvy churches

- Attach PDFs to Payments

- —

- Document Storage

- Event Management

- Everything from Plus

- 10 Users

- Unlimited Names

Membership

$139

For tracking members & contributions!

- Members & Households

- Groups

- Attendance

- Contributions & Statements

- Data Sheets

- Directories

- User Roles & Permissions

- 12 Month Support

Combined

$269

For all your church management needs!

- Everything from Membership

- Everything from Accounting

- Seamless Integration

- –

- –

- –

- User Roles & Permissions

- 12 Month Support

Accounting

$169

For making church bookkeeping easy!

- Check Printing

- True Fund Accounting

- W2 & 1099 Payroll

- Powerful Reporting

- Budgeting

- Register Reconciliation

- User Roles & Permissions

- 12 Month Support

These packages are designed for churches that prefer an offline experience. Desktop users will not be able to take advantage of cloud features like online giving and accessing the program from anywhere.